The global market for Calcium Peroxide is expected to grow between 2023 and 2032, due to factors like the food industry, agriculture application, mining industry, growth in aquaponics and hydroponics, and remediation of the environment.

The Global Calcium Peroxide Market was valued at USD 2.10 Billion in 2022 and is projected to reach USD 4.90 Billion by 2032, registering a CAGR of 3.90% for the forecast period 2023-2032.

Global Calcium Peroxide Market Drivers

- Agriculture Application: In agriculture, calcium peroxide is used as an oxygen source to promote soil aeration. Controlled oxygen release enhances soil structure, facilitating better drainage and plant root development. Calcium peroxide increases aggregation and decreases compaction, which helps to improve soil structure. Higher crop yields and higher-quality crops are a direct result of calcium peroxide's beneficial effects on soil health.

- Food Industry: Using calcium peroxide as a bleaching agent for flour is one of its main uses in the food industry. It does this by oxidizing pigments that may lead to discoloration, which enhances the color of flour. Certain food products' shelf lives have been found to be extended when dough is conditioned with calcium peroxide. Longer-term preservation of the overall quality and freshness of the final products can be achieved by enhancing the dough's stability and performance during processing.

- Mining Industry: Heavy metals precipitate in AMD as a result of the oxidation of metals facilitated by the oxygen released by calcium peroxide. By lowering the levels of toxic metals in discharged water and acidity, it helps lessen the negative environmental effects of mining operations. Calcium peroxide contributes to the restoration of ecosystems in and around mining sites by reducing the effects of AMD. Enhancing the quality of the water facilitates the restoration of aquatic environments, resulting in a more balanced and sustainable ecosystem.

- Growth in aquaponics and hydroponics: Plants grown hydroponically or aquaponically usually have their root systems immersed in water. By releasing oxygen under controlled conditions, calcium peroxide raises the water's oxygen content. The oxygen-releasing property of calcium peroxide aids in preventing anaerobic conditions, which are harmful to plant health. Maintaining ideal oxygen levels is essential for the wellbeing of both fish and plants in aquaponics, where fish waste supplies nutrients for plants.

- Remediation of the environment: Calcium peroxide is used extensively in environmental remediation, where it functions as an oxygen-releasing agent. Calcium peroxide breaks down in contaminated soil or water, releasing oxygen progressively. Bioremediation procedures are improved by calcium peroxide. Microorganisms are essential for decomposing pollutants in contaminated environments. Furthermore, the enhanced soil structure supports the general health of the soil by improving water retention and nutrient availability.

- Evonik successfully closes acquisition of PeroxyChem (2020)

- Evonik expands its peroxides production network with full acquisition of Thai Peroxide Co., Ltd. (2023)

- Solvay announced the expansion of its production capacity for calcium peroxide (2021)

- United Initiators launched a new line of calcium peroxide (2021)

- Kingboard Chemical Holdings Ltd. announced the acquisition of a majority stake in Qianxi County Hongda Chemical Co., Ltd (2019)

Challenges Impacting the Global Calcium Peroxide Market

- Cost and availability: Compared to common deodorizing agents like activated carbon or specific chemical bleaches, CaO₂ can be more expensive. Even in cases where the long-term efficacy of CaO₂ turns out to be more cost-effective, some users may find this initial cost difference to be a barrier. Depending on supply chain logistics and production capacity, the price of CaO₂ can change. Price increases and limited availability may result from supply chain disruptions or limited production capacity in some areas.

- Handling and safety precautions: Workers must receive specialized training on the safe handling, storage, and disposal of calcium peroxide. In comparison to more straightforward solutions, this may discourage adoption by adding an additional layer of training and safety equipment costs for businesses. Potential users may be concerned about calcium peroxide's strong oxidizing properties and potential for skin and eye irritation. This may cause people to be reluctant to embrace it, even though the advantages seem great.

- Regulatory hurdles: Regulating the use, storage, and disposal of calcium peroxide may vary depending on the area and purpose. Its complexity may discourage businesses from adopting it by raising their administrative burdens and compliance expenses. There may be regulatory limitations that restrict the range of uses for calcium peroxide. For example, because of potential health or environmental effects, some regulatory frameworks may not allow its use in certain industries, such as food processing or water treatment.

- Limited awareness and knowledge: Even if someone knows what calcium peroxide is, they may not know all of its many applications. They might not be aware of its potential in odor control, water treatment, soil remediation, and other fields, and instead only associate it with certain uses like teeth whitening or pool sanitation. Making decisions based on incomplete information about calcium peroxide's performance in comparison to other solutions becomes difficult. Due to perceived risks or uncertainties associated with a less familiar technology, users may continue to stick with options that are familiar to them.

- Environmental Concern: Concerns about climate change may arise from the energy-intensive procedures and greenhouse gas emissions associated with the manufacturing of calcium peroxide. Similarly, if transportation is not optimized for efficiency and lower fuel consumption, it can contribute to the environmental footprint. Hazards to the environment can arise from improper disposal of contaminated materials or spent calcium peroxide.

| Attributes | Details |

| Market Size in 2022 | USD 2.10 Billion |

| Market Forecast in 2032 | USD 4.90 Billion |

| Compound Annual Growth Rate (CAGR) | 3.90 % |

| Unit | Revenue (USD Million) and Volume (Kilo Tons) |

| Segmentation | By Grade, By Application, By End-User & By Region |

| By Grade |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Base Year | 2022 |

| Historical Year | 2018 - 2022 |

| Forecast Year | 2023 - 2032 |

Category-wise Analysis:

By Grade:

.png)

- Food: Because there is a growing need for food additives and preservatives. In the food industry, calcium peroxide is used as a dough conditioner, flour enhancer, and bleaching agent. The market for organic and natural food products has grown due to shifting eating habits and growing health concerns. As a result, there is a greater need for calcium peroxide as a natural preservative.

- Industrial: The expanding need for environmentally friendly solutions across a range of sectors, including water treatment, textiles, and pulp and paper. The pulp and paper industry uses calcium peroxide as an environmentally friendly bleaching agent, which fuels demand in this market. Calcium peroxide is also widely used in the textile industry, where it is applied to fabrics to bleach, scour, and de-size them.

- Clarifying Agent: As a potent oxidizer, calcium peroxide dissolves and eliminates contaminants and undesirable colorants from a variety of liquids and surfaces. Because of this, it can be used to clarify applications in a wide range of industries. In contrast to conventional clarifying agents such as hydrogen peroxide or chlorine, calcium peroxide is safer and more environmentally friendly.

- Oxidizing Agent: When making yeast-leavened baked goods, calcium peroxide is frequently used as a quick oxidizing agent, processing aid, or dough conditioner. When flour quality is subpar and gluten needs to be reinforced, the ingredient is required. When the calcium and oxygen are broken down at a high temperature during baking, the calcium peroxide's action stops.

- Deodorizing Agent: As opposed to masking agents, CaO₂ binds to and neutralizes molecules that cause odors, so removing unpleasant odors at their source. CaO₂ deodorizes naturally and biodegradable, unlike harsh chemicals. It is a responsible decision because it presents few risks to both the environment and human health. CaO3 can be reasonably priced, especially in light of its durable odor control. Its value proposition is further enhanced by its simplicity of use and low maintenance requirements.

North America:

- United States: Calcium peroxide is widely used in the food industry, agriculture, and environmental remediation, the U.S. market for it is well-established and strong. The nation's emphasis on natural food preservation techniques and sustainable agricultural methods have led to a significant expansion in the market. Its dominance is further reinforced by strict regulations on wastewater treatment and environmental remediation.

- Canada: Resources like hydrogen peroxide and limestone, which are essential components for making calcium peroxide, are abundant in Canada. Its position in the market is strengthened by this easily accessible supply chain. Calcium peroxide is used in the mining, pulp and paper, and water treatment industries in Canada, all of which are highly developed. The domestic demand drives market expansion. Calcium peroxide's environmentally friendly qualities are in line with Canada's emphasis on sustainability.

- China: The potent oxidizing qualities of calcium peroxide are advantageous for treating industrial wastewater, cleaning lakes and rivers, and eliminating heavy metals from soil. For the production of calcium peroxide, China has an abundance of raw materials, especially lime and hydrogen peroxide, which allows for cost-effective manufacturing and a competitive advantage in the international market.

- India: It boosts crop yields, improves soil health, and inhibits pests and diseases as a soil conditioner and oxidizing agent. This speaks to the enormous agricultural sector in India. Calcium peroxide serves as an oxygen source in contaminated waterways, aiding in the treatment of wastewater and the reduction of pollution. This fits in with India's increasing emphasis on sustainability in the environment. It is essential to India's booming paper and textile industries because it is used as a bleaching agent in the production of textiles and paper.

- Southeast Asia: When it comes to aquaculture—the farming of aquatic species like fish, shellfish, and algae—Southeast Asia is the world leader. This industry uses a lot of calcium peroxide because it effectively cleans aquaculture ponds of toxic bacteria and other pollutants, enhancing water quality and averting disease outbreaks. When calcium peroxide breaks down, oxygen is released, increasing the dissolved oxygen content of ponds—a vital component for the healthy growth of fish. It contributes to the breakdown of organic matter in pond bottoms, lowering dangerous ammonia levels and enhancing pond health in general.

- Western Europe: Food safety and extending shelf life are given top priority in the Western European food and beverage industry. Calcium peroxide improves the quality and appearance of products by acting as a dough conditioner and bleaching agent. When processing ore, calcium peroxide is used as a flotation agent; when refining metal, it is used as a bleaching agent. The long history of mining and metallurgy in Europe contributes to the steady demand for these applications. Problems of soil contamination are actively addressed in Western Europe.

- Eastern Europe: Agriculture is the main industry in Eastern Europe, where calcium peroxide is used in many different ways. It functions as a disinfectant for seeds and farming equipment in addition to increasing crop yields and soil quality. Calcium peroxide is used in the mining and processing sectors of the area for odor control, wastewater treatment, and ore flotation.

- Brazil: With its vast eucalyptus plantations, Brazil is a major player in the global pulp and paper industry. Brightening the pulp and improving the quality of the paper, calcium peroxide is an essential component of the bleaching process. The abundant mineral resources and booming mining sector of Brazil offer an additional application for calcium peroxide. Brazil faces challenges related to water scarcity and contamination.

- Mexico: Mexico has a thriving mining sector, especially for precious metals like gold and silver. In order to increase yield and efficiency, calcium peroxide is used as an oxidizer in metal extraction procedures. Calcium peroxide has several advantages over other oxidizing agents, including biodegradability, safety, and ease of handling.

- Middle East: In the Middle East, calcium peroxide is used in food processing as a bleaching agent in flour manufacturing and as a dough conditioner in the bakery sector. Food security is increased by its use as an oxygen source in modified atmosphere packaging, which prolongs shelf life and lowers food spoilage. A conducive atmosphere for the use of calcium peroxide is created by certain Middle Eastern nations, such as Saudi Arabia and the United Arab Emirates, which support environmentally friendly technology adoption and sustainable waste management.

- Africa: Certain African governments are taking action to encourage the use of calcium peroxide because they understand its potential. Africa has a comparatively unexplored calcium peroxide market with enormous potential for future growth when compared to more developed regions. Calcium peroxide adoption is also aided by growing environmental concerns and the hunt for sustainable substitutes for conventional chemicals.

- Australia and New Zealand: The continued investigation and creation of novel uses and compositions for calcium peroxide could result in a rise in its application. Innovations that increase the effectiveness or adaptability of calcium peroxide may propel market expansion. Its market share may rise as a result of stakeholders and industries becoming more aware of the uses and advantages of calcium peroxide. Information regarding its applications can be shared through outreach initiatives and educational programs.

List of Prominent Players:

- American Elements

- Solvay SA

- BASF SE

- Arkema Group

- Carus Group Inc

- Stp Chem Solutions Co. Ltd

- Zhengzhou Huize Biochemical Technology Co. Ltd

- Evonik Degussa GmbH

- Sunway Lab

- The Dow Chemical Company

- Nikunj Chemicals

- Others

By Grade:

- Food

- Industrial

- Clarifying Agent

- Oxidizing Agent

- Deodorizing Agent

- Others

- Food & Beverages

- Agriculture

- Mining

- Pharmaceuticals

- Paper & Pulp

- Others

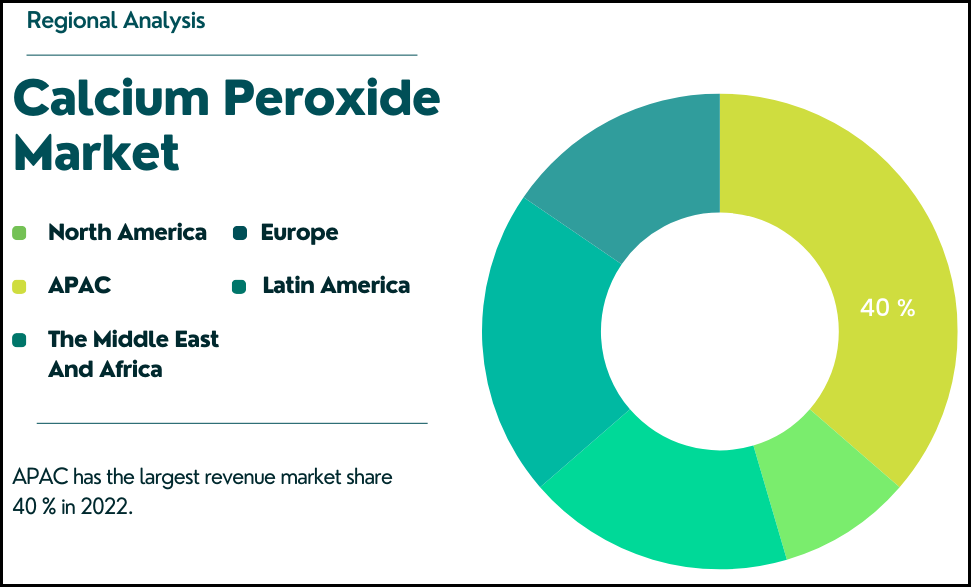

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (GCC Countries, UAE, Rest of MEA)